“The Fund Is About to Dry Up”: Why NYS and Feds Must Audit the UFT Welfare Fund

Millions taken from the Stabilization Fund for wages & given to the city unions’ welfare funds.The UFT now sits on a billion dollar nest egg while members pay more out of pocket for stagnant benefits.

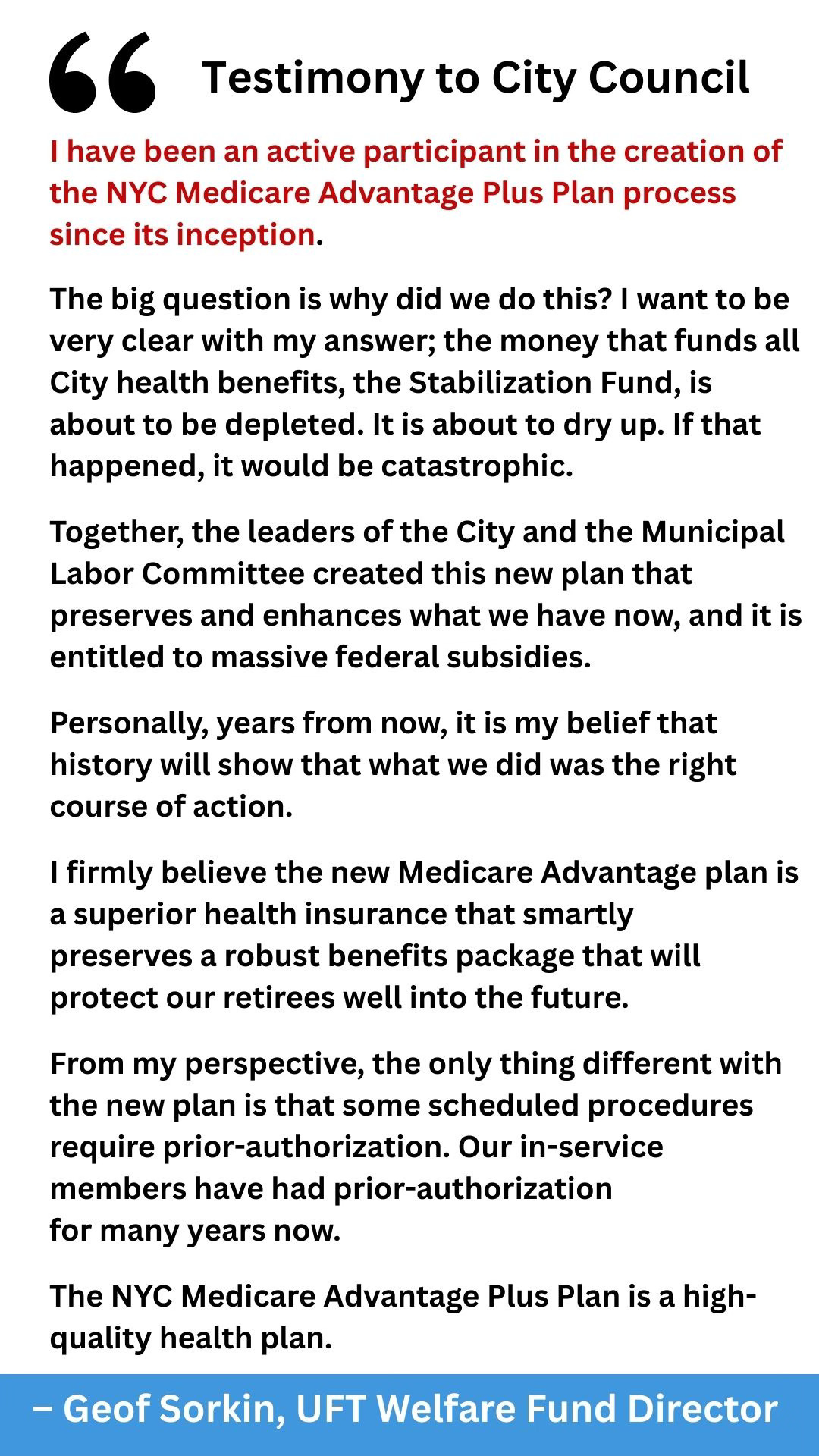

When Geoffrey Sorkin, Executive Director of the United Federation of Teachers Welfare Fund, gave sworn testimony before the New York City Council civil service and labor committee in 2021, his warning was unmistakable.

The money that supports City health benefits, he said, was “about to be depleted.” If that happened, it would be “catastrophic.”

He lied to us all, including City Council, when he said the Healthcare Stabilization Fund (HSF) is what funds all city healthcare benefits — but that’s not the rub.

The looming threat to the Stabilization Fund, Sorkin explained, justified the creation of the NYC Medicare Advantage Plus Plan—a plan he described as financially necessary, federally subsidized, and ultimately superior for retirees. From his perspective, the main difference was straightforward: more prior authorizations.

That testimony’s rationale has since been used to undergird some of the most consequential changes to educator and retiree health care in recent memory. But when the financial record is examined closely, a troubling disconnect emerges—one that raises serious questions about transparency, governance, and who is actually bearing the cost of these decisions.

The dutiful skeptic might go further in asking: Was this a manufactured crisis of the City’s and MLC’s making, while the unions raided the Stabilization fund for retro-wages and cashed in on bulk transfers for their own welfare funds, and the city’s Office of Labor Relation got its long-suspected wish of seeing the HSF dissolve? Conversely, convincing city workers and retirees that more sacrifices in the form of “cost saving” measures to their healthcare needed to be taken to “replenish” the ever-bleeding Stabilization Fund?

The Raiding of the Stabilization Fund

The New York City Healthcare Stabilization Fund was created as a financial backstop to protect the health benefits of municipal workers and retirees during periods of economic stress. Its stated purpose was straightforward: to absorb and offset rising healthcare costs, prevent sudden premium increases or benefit cuts, and ensure continuity of coverage for workers, retirees, and their families. Importantly, the fund also carried moral and legal obligations beyond routine labor costs, including payments tied to long-term liabilities such as healthcare and survivor benefits for 9/11 widows and orphans—families whose loved ones died in service to the city. In public statements and labor agreements, city and union leaders repeatedly described the Stabilization Fund as a safeguard that must be preserved to avoid catastrophic consequences if it were ever depleted — with healthcare being its purpose.

Yet over time, the Stabilization Fund was systematically circumvented and repurposed, not through an open public debate, but through a series of bulk transfers and cost-shifting maneuvers that drained the fund while preserving the appearance of fiscal stability. Hundreds of millions of dollars were removed to plug unrelated budget holes, finance a billion dollars in retroactive wage increases, and seed union-controlled welfare funds—often without meaningful transparency or city union member consent. As a related tangent, we must also keep in mind that some of the city union welfare funds are not only used for healthcare benefits.

At the same time, rank-and-file workers and retirees were told that benefit reductions, higher out-of-pocket costs, and drastic changes such as forced enrollment into Medicare Advantage were “necessary” to save a fund that had already been hollowed out.

The result was a paradox: a Stabilization Fund declared too depleted to meet its core obligations— including commitments to 9/11 survivors—while substantial sums earmarked for healthcare were moved and sat outside the fund, beyond public and member oversight, as members paid more and received less.

If this was not enough, now, the City and the MLC, along with Mulgrew, want to manage a self-funded healthcare plan for city workers after bankrupting the stabilization fund. And no one has yet to answer how PICA drugs will be covered without the Stabilization Fund — even as Express Scripts is owed millions of dollars.

Members Pay More—While the Welfare Fund Grows

For active educators and retirees, the lived reality is clear.

Ask anyone who has had to pay thousands of dollars out of pocket for dental care as the reimbursement schedule has remained virtually unchanged in years.

Out-of-pocket costs have increased. Dental, vision, and prescription benefits remain limited — with some minor upgrades happening during the UFT election season.

Retirees face new layers of bureaucracy, delayed care, and denials tied to prior-authorization requirements. In-service members quietly absorb higher copays and utilization controls that were once promised would be temporary.

These changes were framed as unavoidable—necessary sacrifices to prevent financial collapse.

Yet the UFT Welfare Fund is not funded by private capital or discretionary reserves. It is financed by taxpayer dollars contributed by the City of New York and by member-derived funds tied to negotiated benefits. The same is true about the monies transferred from the Stabilization Fund. That makes its stewardship a matter of public trust as well as union responsibility.

And the numbers tell a different story.

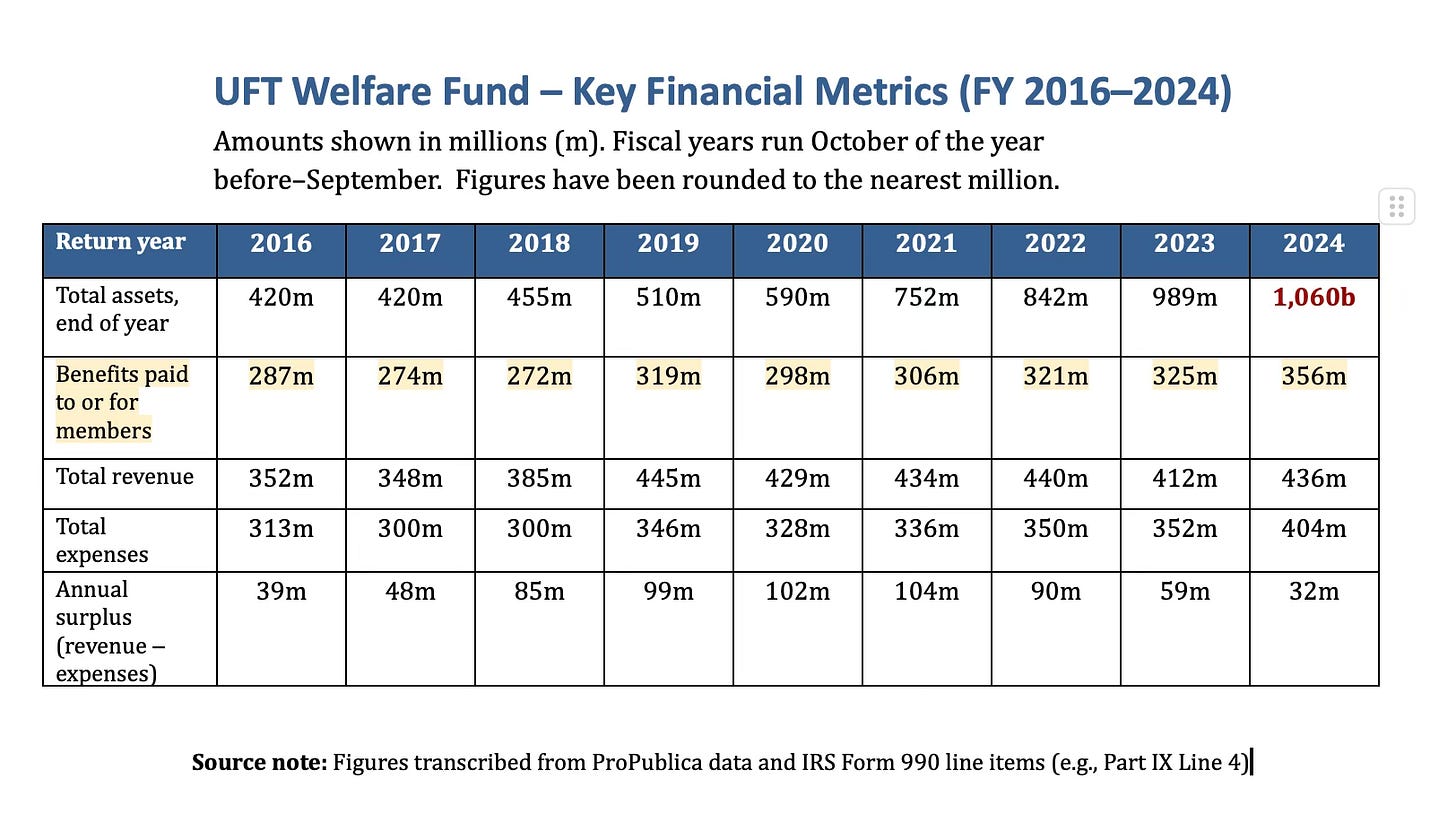

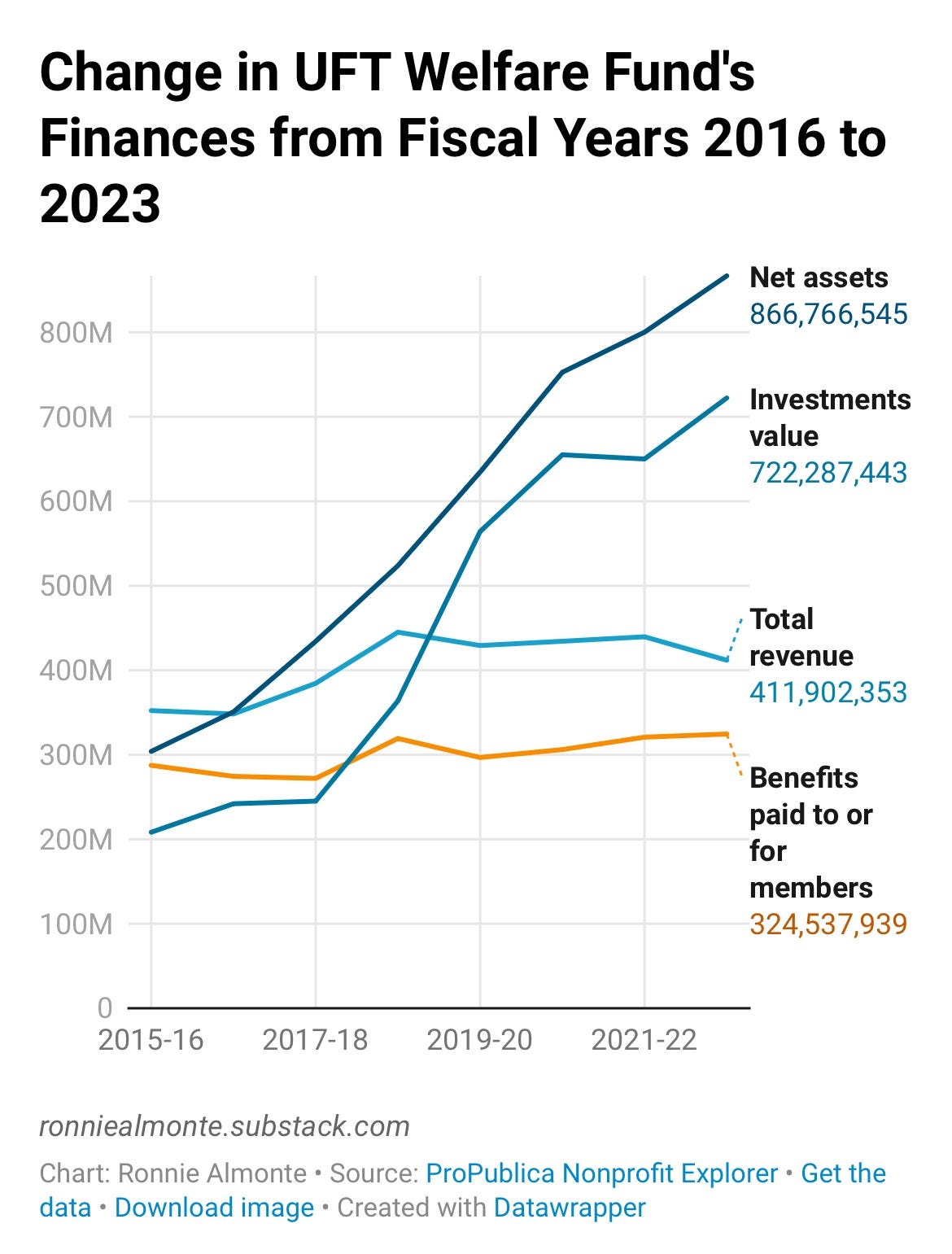

Over the past 10 years, the Welfare Fund’s assets have grown exponentially, surpassing $1 billion in the most recent filing. Each year, the fund took in more than it spent. Even in its last filing for tax year FY 23-24 —after slightly higher benefit payments and administrative costs—the fund ended the year with tens of millions of dollars added to its reserves.

This is not a fund on the verge of depletion, nor one affected by healthcare cost spikes. It is a fund accumulating wealth—while members are paying more and more out of pocket while unable to see behind the curtain or hold trustees accountable.

Administrative Costs Rise as Benefits Stand Nearly Still

At the same time members were being told there was no alternative to cost-shifting, internal spending moved sharply in another direction.

Administrative compensation increased dramatically in the most recent year, despite a reduction in staffing levels. An especially opaque category—we’ve labeled simply “other expenses”—nearly doubled in a single year, rising into the tens of millions of dollars.

These are precisely the categories where consulting fees, legal services, and internal cost-sharing arrangements often appear. Yet members have no access to detailed explanations. There are no public minutes describing why these costs rose, no itemized disclosures, and no opportunity for educators or retirees to evaluate whether these expenditures improved their benefits or merely expanded overhead.

In the last UFT Welfare Fund 990 filing, all of the following happened simultaneously:

“Other expenses” jumped by ~$11.5M, nearly doubling from the year before

Salaries jumped by ~$7.6M while staff was cut

Investment income doubled

Assets still increased by $70M+

Members were still told more austerity was necessary

And yet there is no corresponding disclosure of related-party cash flows that appear anywhere obvious in the return.

It’s becoming more and more apparent that the real red flags appear in the “Other functional expenses” section of recent Welfare Fund filings. We looked at other expenses beyond compensation and benefits paid out (Section IX, sections 11-24e of 990 form).

We totaled these to be:

2021: $11.7M

2022: $12.4M

2023: $23.9M (nearly doubled in one year)

And while the amount spent on benefits usually were in alignment to healthcare inflation, it is most definitely not proportional to the monies that have grown in the fund.

Benefits paid to members are barely keeping up with inflation in the healthcare industry even in the last couple of years:

FY 2022-23: $324.5M

FY 2023-24: $356.1M (+9.7%)

This slightly modest increase, however, lags far behind:

growth in assets

growth in investment income

growth in administrative spending

The bottom line is that members are seeing slight benefit increases that attempt to keep up with inflation while the fund’s balance sheet and overhead balloon.

It is important to note that the amount of benefits paid to members dipped in 2017 and 2018 from the previous years even as assets began to stockpile from the stabilization fund transfers in the last decade, special provisions in the UFT labor contracts and $50 million per year from the City for paid parental leave, beginning in 2018.

Decisions Without Representation or Records

The structure of the Welfare Fund’s governance only deepens concern.

There are no independent in-service trustees on the Welfare Fund board — it is overwhelmingly comprised of UFT officers.

There is no rank-and-file representation.

Retirees—whose health coverage has been most affected by Medicare Advantage and prior authorization—have no formal voice. Meetings are closed. Minutes are not published. Votes are not made public. Essentially, this is the non-transparent governance approach held by the city unions in the Municipal Labor Committee (MLC).

Major decisions affecting health care for hundreds of thousands of people have been made behind closed doors, justified after the fact by warnings of financial catastrophe.

Members were misled by the union leadership, MLC and City about the financial necessity of cost saving changes in the 2014 and 2018 healthcare agreements to replenish the Stabilization Fund, and the nature of the funds involved—claims that have not been publicly answered with transparent accounting.

Prior Authorization as Policy, Not Necessity

In his testimony, Sorkin downplayed prior authorization, describing it as a routine feature of modern health insurance. But for educators and retirees, prior authorization is not an abstract concept. It is a delayed procedure. A denied referral. A medication held up while paperwork circulates.

These mechanisms are not neutral. They are cost-containment tools designed to reduce utilization by shifting time, risk, and stress onto patients.

The contradiction is striking: access to care is being restricted in the name of savings at the very moment more than a billion dollars in taxpayer-funded and member-derived assets sit idle.

A Growing Credibility Gap

Educators are not demanding extravagance. They are demanding honesty and transparency.

If benefits must be constrained, members deserve a clear explanation grounded in transparent financial facts. If reserves must grow, members deserve to know why—and for whose benefit. If administrative costs rise sharply, those decisions require public justification.

What members have received instead is a steady narrative of scarcity, paired with policies that increase their personal costs, even as the Welfare Fund’s balance sheet reaches historic highs. While members fall prey to vitriolic, vengeful attacks by leadership on all those who ask tough questions within the union’s circles.

Time for More Independent Oversight

This is no longer an internal union matter. The UFT Welfare Fund manages vast sums of taxpayer money and negotiated member benefits, and its decisions affect educators, retirees, and their families across New York City.

That is why independent scrutiny is now essential.

For one, there are no rank and file trustees on the Welfare Fund board. Compare that with the retirees that sit on the UFT’s SHIP board. The present Welfare Fund board shares little to nothing about proceedings, minutes or itemized financials. For a fund this large in assets, this is unconscionable.

State and federal oversight agencies should examine the fund’s finances, governance practices, and related-party arrangements—not to prejudge wrongdoing, but to restore trust through transparency.

Those tasked with defending the status quo will say the New York City Comptroller audits the city union Welfare Funds. This is true.

Yet, ask them when was the last time. Have they read the audits and financials? Where can members access these audits and financials on the UFT portal? Do they know what they include and don’t include? And, do these audits and/or financials show an itemized account of benefits managed by the UFT Welfare Fund?

How are internal costs being allocated, and who sets the rules? The costs seem to fluctuate disproportionately and disparately for certain items expensed from year to year.

Moreover, when were UFT members told that the Welfare Fund had already contracted United Healthcare/United Medical Resources as a third-party benefits administrator, years ago? According to the filings, the UFT forged a working partnership with UMR since around 2020, even before the upcoming premium-free healthcare plan (NYCEPPO) switch by the City and MLC (see Independent Contractors line of the 990s, 2020-24).

Is it safe to say that Sorkin and Mulgrew have had a working relationship with United Healthcare since 2020? Does this relationship partially explain why administrative costs have skyrocketed? Does it help explain how so many city workers, retirees and their dependents will land with United Healthcare and its preauthorization machine in 2026?

The truth is, New York City Comptroller, Brad Lander, has dragged his feet in releasing a much-awaited audit of the now bankrupted New York City Stabilization Fund even as he’s in his final days in the office. Lander appears to be conflicted as he openly solicits union endorsements for the various offices he’s sought to run for as a candidate in the last few months — including mayor and now, Congress.

This needs a fresh set of eyes. Because when educators are paying more to get less in the midst of an “affordability crisis”, while being told the cupboard is bare, the public deserves to know:

Where did our money really go in OUR FUND?

It’s high time we find out.

We call on New York City Council, the New York State Attorney General and State Comptroller, and related federal agencies, such as the Department of Labor, to start digging into this matter and other related issues.

This call to action may also need to include petitioning some oversight from the Congressional House Committee on Education and Workforce that is presently “seeking input from stakeholders to inform Congress how it can reform the LMRDA to ensure labor organizations adhere to the highest standards of responsibility and ethical conduct.”

Our dues. Our fund. Our union.

So, open the damn books.

Editor’s Postscript:

There are many more questions and revelations that have surfaced since we started this deep dive into the Welfare Fund finances.

We will unpack them in the coming days. Others related issues have arisen.

These also include:

How DC 37’s Welfare Fund spent its money from its share of the NYC Stabilization Fund in the last few years — with hundreds of millions in remodeling costs of its union building, according to its 990 filings over the last 4 years. Before 2014, the DC 37 Benefits Fund was once bleeding money, and reportedly on the verge of collapse, until the infusion of millions in cash from the Stabilization Fund, especially after 2018. In a complete 180, it also sits perched on nearly 900 million dollars in assets.

Meanwhile, their Welfare Benefits Fund has contracted Hunter Roberts Construction for millions in the last few years for demolition and remodeling of the union building owned by DC 37. They paid over $102 million alone to this company according to its last filing. This decision to hire them was made not too shortly after Hunter Roberts agreed to pay over 7 million in penalties and restitution for engaging in a fraudulent overbilling scheme.

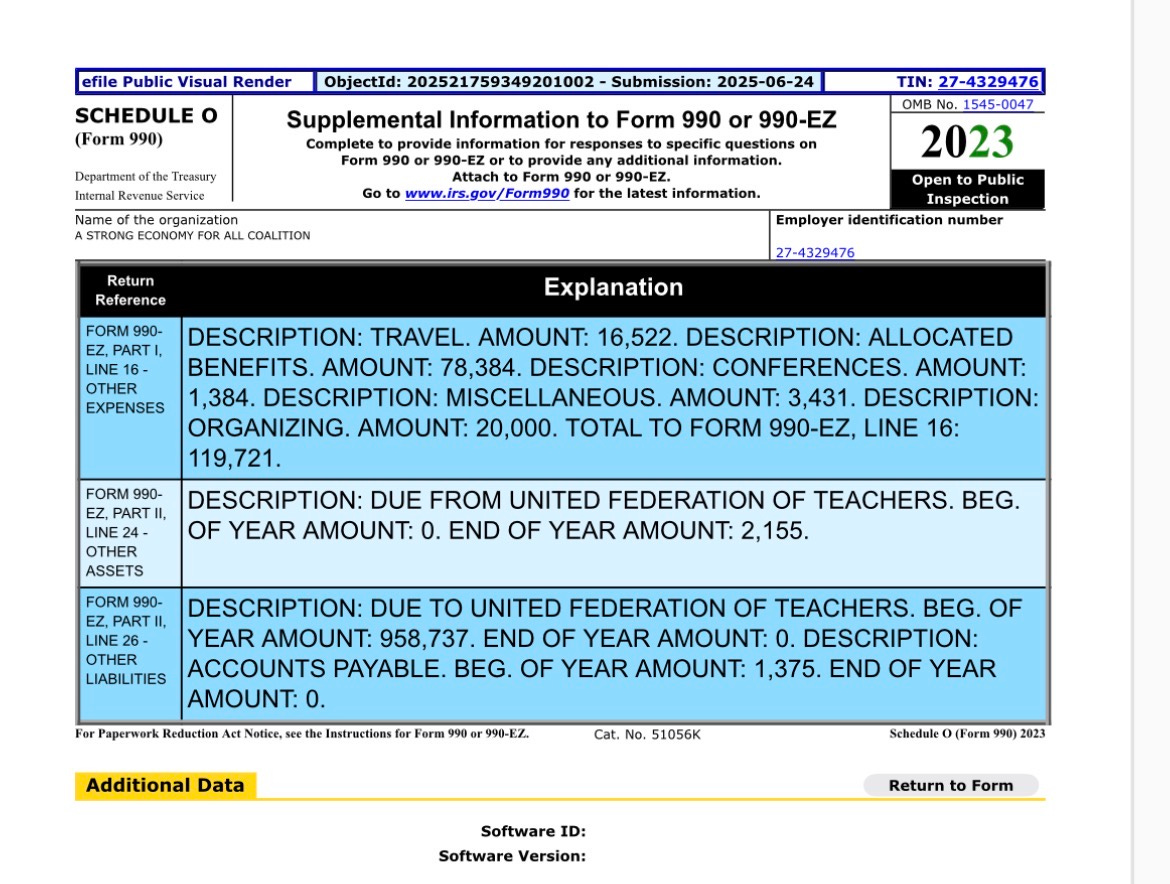

A Strong Economy for All Coalition is a New York–based 501(c)(4) “issue advocacy” nonprofit that publicly presents itself as a labor- and community-aligned policy organization. Media coverage has identified Michael Kink as its executive director in connection with state policy campaigns. Kink is also listed on the UFT payroll as a supervisor, earning over $200,000 annually. While the UFT’s Chief Financial Officer, David Hickey serves at the coalition’s treasurer. Charles Khan, the coalition deputy director, is listed as holding a clerical position on the UFT filings and is still listed as making $118,000 a year.

As a social-welfare organization, the coalition can engage in significant advocacy and lobbying and—unlike a charity—does not have to disclose its donors. It is routinely described in press accounts as union-aligned and linked to public-employee unions, including New York City’s teacher-union ecosystem.

Federal labor filings list “A STRONG ECONOMY FOR ALL” at 52 Broadway, 11th Floor, the same address used in its IRS filings and owned by the UFT. That overlap reinforces the perception that the coalition operates squarely within the UFT orbit as its own lobbying front, despite the fact that most UFT members would likely report having never heard of the organization or its work.

The most serious questions arise from its recent IRS filings. In its 2022 Form 990, the coalition reported a sharp revenue increase to roughly $845,000, alongside a surge in liabilities to $960,112 and “other expenses” totaling $1.19 million. In its 2023 Form 990-EZ, cash and investments fell from $995,878 to $91,470, while liabilities dropped from $960,112 to $0—a swing of nearly $1 million with no clear public explanation.

What was this $960,000 liability—a loan, a payable, or a pass-through obligation? Who was it owed to, and how was it extinguished while nearly the same amount of cash disappeared? And what, if anything, has been disclosed to union members about a lobbying organization carrying—and then erasing—a nearly million-dollar obligation reportedly due to the union?

Also see:

Excellent abd informative piece.

So how can we get an audit underway?

What steps are needed to ensure that it happens?

Excellent and long awaited assessment. We need an independent forensic audit. The City Council and other entities mentioned are in the pockets of the unions. Just as Pete Harckham (NYS senator) caved to pressure from the afl-cio on the NYS bill to protect all NYS retiree health benefits. Mulgrew is on the board of the AFL-CIO. Harckham was threatened with loss of support and donations. There is a seasoned professional who has done forensic audits for various pension funds. Time to blow the whistle.